The thesis aims to answer two questions utilizing Norwegian data for 2007; 1) what is the distribution of taxes and public spending across different income deciles and household types? and 2) taking this into account, how does it affect income inequality and poverty? By adjusting income for indirect taxes, the payroll tax and the value of public services utilized by households, I find that income inequality and poverty is substantially reduced due to large differences in the fiscal incidence.

Fiscal incidence in Norway - who pays taxes and who receives government spending?

In his master thesis Ragnar Juelsrud investigates how much different households and individuals get back from the state for each krone they pay in tax. This is a central question to be answered when aiming to describe the distributional properties of the fiscal budget.

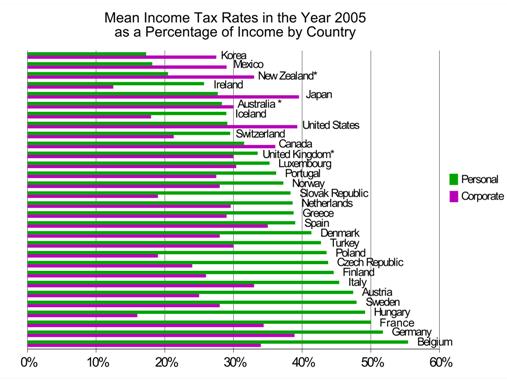

Source: OECD

Published Aug. 1, 2013 11:12 AM

- Last modified Aug. 6, 2013 9:06 AM