Abstract

In 2013 Iran and the P5+1 agreed on the Joint Plan of Action (JPA) which established a framework for further negotiations over Iran’s nuclear programme, and this thesis explores the question: Did the U.S. economic sanctions imposed against Iran in the period 2010-2013 lead to Iran’s acceptance of the JPA? This single case study relies on a theory for when imposed sanctions might work, from which three hypotheses are derived. The research question is answered in the affirmative, despite theoretical expectations to the opposite, and the ineffectiveness of previous sanctions against Iran. Iran’s government yielded because it underestimated the potency of the sanctions which significantly hurt its oil revenues, and forced non-sanctioning countries into reducing their trade with Iran. Iran’s government also believed initially that sanctions would be imposed regardless of whether it yielded or not, but agreed to the JPA when it realized that this would lead to sanctions-relief.

1. Introduction and research question

On November 24, 2013 Iran and the P5+1 which consists of the permanent members of the United Nations Security Council (UNSC) as well as Germany, agreed on the Joint Plan of Action (JPA). The plan was meant as a stepping stone for further negotiations from which a permanent and comprehensive deal over Iran’s nuclear programme could be reached, and Iran agreed to halt key aspects of its nuclear programme in exchange for moderate sanctions relief (EEAS 2013). The JPA kick-started negotiations over Iran’s nuclear programme after years of negligible progress, and in April, 2015 the negotiating parties agreed on the general framework for a deal with the deadline for a final agreement set to June 30 (Samore 2015).

The U.S. has since 1979 largely relied on economic sanctions to influence Iran’s policies. However, scholars such as Clarke (2013: 504-505), Fathollah-Nejad (2014), Schott (2012:and Takeyh and Maloney (2011: 1299-1304), maintain that sanctions have rarely or never succeeded in inducing any major changes in Iran’s policies. Nevertheless, in 2010 the Obama administration expanded the sanctions regime against Iran with the goal of forcing it into serious negotiations over its nuclear programme (O’Sullivan 2010: 11-12). Significantly, while Takeyh and Maloney (2011: 1298) predicted that these new sanctions were unlikely to succeed, Cordesman, Gold and Coughlin-Schulte (2014: viii) claimed in the aftermath of the JPA that Iran’s willingness to negotiate to a large extent was a result of the sanctions.

It is not clear why sanctions would work now if they have not done so before, so this claim should not be left unexplored. This thesis aims to answer the question: Did the U.S. economic sanctions imposed against Iran in the period 2010-2013 lead to Iran’s acceptance of the JPA? First, a theory on when imposed sanctions can be expected to work and three derivative hypotheses will be presented. Second, the sanctions regime before 2010 will be discussed, where it will be shown that the effectiveness of previous sanctions were undermined by their unilateral nature and failure to hit Iran’s oil revenues. Third, the three hypotheses will be tested and it will be shown that Iran’s leaders likely expected the imposition of sanctions, but underestimated their potency because oil sanctions against Iran succeeded unexpectedly. Iran’s leaders believed initially that sanctions-relief could not be obtained through negotiations, but accepted the JPA when they realized the opposite. Lastly, the implications of these findings will be discussed.

2. Theory and Method

2.1 Theory

To use economic sanctions means to implement trade- or financial restrictions against a target state to inflict an economic cost on it, and coerce it into making political concessions (Pape 1997: 93-94). Sanctions have, according to Lindsay (1986: 158), succeeded if the following two criteria have been fulfilled: “First, the target must alter its behaviour to conform with the initiator’s preferences. Second, the target must change its policies because of the sanctions”. However, several scholars maintain that sanctions are rarely effective. Hufbauer, Schott, Elliott and Oegg (2007: 158-159) for example, found that sanctions were at least partially successful in only 34 % of the 174 cases they studied, concluding that sanctions “often do not work”. Pape (1997: 106), studying the same data, found a success rate of less than 5 % and concluded that sanctions do not work at all. Drezner (2003: 644-647), however, argues that these studies suffer from selection bias, as game-theoretic approaches expect sanctions to be more effective at the threat level than after their imposition.

Hovi, Huseby and Sprinz (2005: 484-486) have attempted to explain why targeted states might nevertheless yield after the threat of sanctions fails, and sanctions have been imposed. When faced with the threat of sanctions, the targeted state will: (1) assess how credible the threat is, (2) if the benefits of noncompliance outweigh the costs of the sanctions, and (3) if the threat is noncontingent, meaning that sanctions will be imposed whether it complies or not. If the target chooses noncompliance the theoretical expectation, assuming it has complete information, is that one of two things will happen. (1) Either the sanctions are not imposed because the threat is empty, or (2) they are imposed but the target will not yield because it believes that the benefits of noncompliance outweigh the costs of sanctions, or that the threat is noncontingent. Therefore, if the target has complete information and does not yield when threatened with sanctions, it will not do so after sanctions have been imposed either. So if the target yields after sanctions have been imposed it must have made a miscalculation.

According to Hovi, Huseby and Sprinz (2005: 486-489), imposed sanctions might succeed if the target has made a miscalculation in at least one of three ways. First, it might have underestimated the determination of the sender to impose sanctions, wrongly believing the threat of sanctions to be empty. If the threat of continued potent sanctions is both credible and contingent it might choose to yield. Second, it might have underestimated the potency of the threatened sanctions, initially assuming that the benefits of noncompliance would outweigh the cost of sanctions, but the sanctions proved to be more costly than expected. The target might yield if the threat of sustained sanctions is credible and contingent. Third, the target might have perceived the threat to be noncontingent when it was not, believing that sanctions would be imposed even if it complied. If the sender convincingly signals that sanctions will be lifted if the target yields, it might do so. The following three hypotheses will be used to explore why Iran yielded to the demand that it had to participate in negotiations on the nuclear issue:

H1: The threat of sanctions failed because the threat did not seem credible. The Iranian government yielded when sanctions were unexpectedly imposed.

H2: The threat of sanctions failed because the threatened sanctions seemed less potent than they turned out to be. Iran yielded when it realized that the cost of the sanctions was intolerable.

H3: The threat of sanctions failed because Iran thought that sanctions would be imposed regardless of whether it complied or not. It yielded once it seemed likely that sanctions would be lifted in return.

2.2 Method

As was shown above, Hufbauer et al. (2007) and Pape (1997) see sanctions as inefficient, while Drezner (2003) maintains that sanctions are more effective at the threat stage. This thesis aims to complement the existing sanctions literature by exploring in-depth a case where sanctions might have succeeded, contrary to the theoretical expectations, by employing a hypothesis testing case-study approach (Levy 2008: 6). Gerring (2007: 20) defines case studies as: “...the intensive study of a single case where the purpose of that study is- at least in part- to shed light on a larger class of cases…”. Single case studies will necessarily have low external validity, and so the findings of this thesis might not be applicable to other cases. However, this study emphasizes internal validity to explore in-depth how the political context and the design of the sanctions might have led to an outcome that deviates from the theoretical expectations (Gerring 2007: 43).

3. The Sanctions Regime

3.1 Why were previous U.S. sanctions ineffective?

The U.S. has since the 1979 Islamic Revolution, and the hostage taking of American embassy personnel in Tehran, relied on a “carrot-and-stick” approach against Iran. This entails using sanctions to make behaviour the U.S. disagrees with costly, and to persuade Iran into participating in negotiations (Takeyh and Maloney 2011: 1298-1300). However, the release of the hostages after the 1981 Algiers Accords may, according to Takeyh and Maloney (2011: 1299): “… offer the single striking example of the efficacy of sanctions in producing a demonstrable concession from Tehran…”, though some scholars maintain that the deal came about for other reasons (Emery 2010: 372-373). Why have sanctions against Iran rarely been effective?

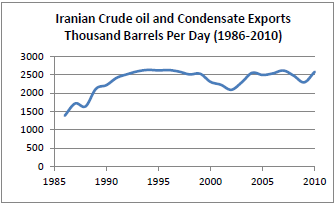

The U.S. sanctions regime against Iran was significantly expanded after the U.S. designated Iran as a state sponsor of terrorism following the bombing of a U.S. barracks in Beirut in 1983. In 1987 the U.S. banned all imports from Iran including crude oil. This did not significantly affect Iran’s crude exports, allowing Iran’s oil exports to reach 2.6 million barrels per day (bbl/d) by the mid-1990s as figure 1 illustrates. This was because the U.S. failed to gather multilateral support for sanctions, and Iran could therefore easily sell its oil to other countries (Takeyh and Maloney 2010: 1301; Van de Graaf 2013: 151). The sanctions regime was significantly undermined as a result, because Iran’s government could rely on its oil revenues to sustain itself (Nader 2012: 214).

The sanctions regime was expanded again during the Clinton Administration, most significantly with the Iran and Libya Sanctions Act of 1996 (ILSA) which allowed the President to sanction non-U.S. companies that invested in Iran’s energy sector (Katzman 2015: 9). The ILSA failed, however, because like all U.S. sanctions against Iran prior to 2010 it received minimal international support. The EU opposed it fiercely because it allowed the U.S. President to sanction European companies. As a result, European and East-Asian companies continued investing in Iran’s energy sector, and no companies were punished under this act until 2010 (Patterson 2013: 136-137). The sanctions were therefore undermined by Iran’s trade with non-sanctioning countries.

The lack of international support for sanctions, and the failure to hit Iran’s oil revenues were two major, though not the only, weaknesses of the U.S. sanctions regime against Iran. Sanctions therefore failed to devastate Iran’s economy and actually benefitted Iran’s Revolutionary Guard as it gained control over Iran’s black market (Gheissari and Nasr 2005: 181). As a result, sanctions failed to impact Iran’s policies such as making it cease its support of terrorist groups, or to make any serious compromises over its nuclear programme (Mohsen 2009: 55-56; Takeyh and Maloney 2011: 1298).

3.2 The Nuclear Issue and the UNSC 2002-2010:

The issue of Iran’s nuclear programme became particularly salient in 2002 following the revelation of two undeclared Iranian nuclear facilities. Iran, as a result, halted its enrichment activities and agreed to negotiations with the EU3 consisting of France, Germany and the UK (Patterson 2013: 138). After these negotiations failed in 2005, the EU3 was joined by Russia, China and the U.S. to form the P5+1, which has since acted as a counterpart to Iran on the nuclear issue. Talks between the P5+1 and Iran were held in Geneva and Vienna in 2009, but both ended in failure (Bowen and Moran 2014: 42; Parsi 2012: 142). As a result, in 2010 the UNSC imposed the latest of four rounds of sanctions enacted in the period 2006-2010. While these are the only universal sanctions against Iran, they were devised to inhibit its nuclear programme, not to cripple its economy (Bowen and Brewer 2011: 934-935).

3.3 The sanctions regime after 2010:

In 2009 the newly instated Obama administration made overtures towards Iran in an attempt to initiate negotiations on the nuclear issue. Its stance toughened considerably, however, after the failure of the Geneva and Vienna talks, a crackdown on Iranian protesters, and the revelation of another undeclared enrichment facility in 2009. As a result, the Obama administration settled on a “dual-track” strategy which entailed that concurrent with diplomatic outreach, the U.S. threatened to punish Iran economically if diplomacy failed. Following the 2010 UNSC sanctions, the U.S. ventured into the “second track” and imposed sanctions of its own, the most important of which were the 2010 Comprehensive Iran Sanctions and Divestment Act (CISADA), and the 2012 National Defense Authorization Act (NDAA) (Parsi 2012: 151-152; Van de Graaf 2013: 148).

These measures were devised to avoid the deficiencies of previous sanctions, first by inhibiting Iran’s ability to trade with third-party countries. This effort began with the CISADA which banned the sale of refined petroleum products to Iran. The CISADA was extraterritorial, meaning that the U.S. threatened to penalize non-U.S. companies if they broke the CISADA’s provisions, and all the sanctions subsequent to the CISADA would share this extraterritorial feature (O’Sullivan 2013: 40). Second, the sanctions targeted Iran’s oil revenues, beginning with the NDAA which threatened denial of access to the U.S. financial markets to foreign banks that processed oil payments through the Central Bank of Iran (Van de Graaf 2013: 148-149). The significance of these measures will be treated in the following sections.

4. Testing the hypotheses

H1: The threat of sanctions failed because the threat did not seem credible. The Iranian government yielded when sanctions were unexpectedly imposed.

Is it likely that Iran’s leaders thought that not yielding to the demand that it must negotiate with the P5+1 over its nuclear programme would not result in sanctions? Cases were the target did not expect sanctions are according to Hovi, Huseby and Sprinz (2005: 486): “…few and far between” simply because the process of imposing sanctions takes time, giving the target time to assess how credible the threat of sanctions is. Was there any reason to believe that the U.S. threat of sanctions was empty?

There was in fact concern among some U.S. allies, France in particular, that the U.S. was about to “go soft” on Iran when the Obama administration came into office (Parsi 2012: 11-13). In November 2009, however, the Obama administration settled on the sanctions track, largely because of the failure of the Geneva talks (Maloney 2013 2013: 97; Parsi 2012: 151). The signs that the White House was pursuing sanctions were quite clear as U.S. diplomatic manoeuvres in late 2009 “…heightened expectations that sanctions would supplant diplomacy…” (Maloney 2010: 135). This entailed the U.S. seeking international support for sanctions, first by arranging a meeting with like-minded nations prior to the 2009 Vienna negotiations, and second by pushing for the 2010 UNSC sanctions (Parsi 2012: 161-165). The UNSC sanctions “signalled” that the U.S. was pursuing the sanctions approach because the U.S. only imposed sanctions of its own after the UNSC sanctions were passed. The U.S. also tried to soften Russia’s opposition to sanctions by ending plans for a missile defence system in Europe, as well as China’s resistance by encouraging Saudi Arabia to increase energy exports to it (Maloney 2010: 135-136; Parsi 2012: 164). This likely strengthened the credibility of the threat of sanctions, because the U.S. would not have made these diplomatic manoeuvres if the threat was empty.

Iran was well aware of the U.S. drive towards sanctions. For example, when asked about the threat of U.S. sanctions, Iran’s chief nuclear negotiator Saeed Jalili responded: “What is new about that?” while boasting that sanctions would not “…bring a great nation like Iran to its knees” (Der Spiegel 2009). Iranian officials have historically sought to portray sanctions against Iran as ineffective, and maintained this attitude of defiance against the threat of new sanctions as well. The credibility of the threat was not called into question, however, likely because it has become part of the regime’s ideological narrative that the U.S. wants to undermine the Islamic regime through sanctions (Maloney 2013: 93; Takeyh and Maloney 2011: 1305-1307). Given this ideological narrative, and the very public U.S. diplomatic manoeuvres, it seems unlikely that Iran saw the threat of sanctions as empty. H1 therefore seems improbable.

H2: The threat of sanctions failed because the threatened sanctions seemed less potent than they turned out to be. Iran yielded when it realized that the cost of the sanctions was intolerable.

While Iran likely expected the imposition of sanctions, might its decision to yield have come about because it underestimated their potency? Maloney (2010: 132) warned that: “…the prospect of crippling the Iranian economy is a fallacy…”. This was because previous sanctions had shown that Iran’s oil revenues were seemingly insulated from sanctions, and because multilateral support was unlikely (Maloney 2010: 139-142). The new sanctions were devised to make up for these deficiencies, but did it work?

Oil is traded on a globally integrated market, meaning that supply- or demand-shifts affect the price of oil globally to the benefit or detriment of friends and foes alike (Fattouh 2014: 23; Van de Graaf 2013: 149-150). Because Iran was the world’s fifth largest oil producer, some feared that cutting Iranian oil from the global market would lead to an oil-price spike which would hurt the global economy (Solingen 2012: 311-312). The International Monetary Fund for example, warned in early 2012 that oil sanctions on Iran could push the price of oil up by twenty to thirty percent (Gosden 2012). As a result, neither sanctions experts nor oil-market analysts expected that oil sanctions against Iran would succeed (Van de Graaf 2013:145).

A price spike had to be avoided because it would make the sanctions too costly to maintain, would discourage international support, and would allow Iran to sell its oil at a higher price, thus boosting its revenues (Canes 2000: 138-139; Van de Graaf 2013: 154). To avoid this, the NDAA required that every 180 days the U.S. government had to determine if the global oil market was sufficiently supplied, absent Iranian exports (Van de Graaf 2013: 148-149). If not, it could extend sanctions waivers to stabilize the market. This provision was never used, however, as the loss of Iranian oil was offset by increased production elsewhere (Blackwill and O’Sullivan 2014: 111).

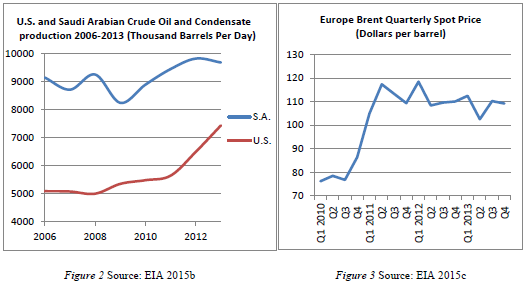

This was partly a result of a Saudi Arabian production increase of 700 bbl/d between 2010 and 2013, as well as increased production by other OPEC members, but this proved to be inadequate to offset the drop in Iranian exports. This was in part because an increase in OPEC’s production would lead to reduced global spare production capacity, which could unnerve the market and push prices upwards (Blackwill and O’Sullivan 2014: 105; EIA 2015b). However, the U.S. production growth between 2010 and 2013 was far steeper than the Saudi growth as figure 2 illustrates. This was the “shale revolution” (Morse 2014).

The increase in U.S. oil production was described by Morse (2014: 3) as “…nothing short of astonishing” as it grew from five million bbl/d in 2008 to eight million bbl/d in 2014. A report by the International Energy Agency (IEA) described this development as: “…rapid and largely unexpected…”, and in just a few years there was a shift from a perceived global scarcity of oil to near abundance (Fattouh 2014: 24; 102; IEA 2012: 56). Blackwill and O’Sullivan (2014: 111) write that: “It would have been nearly impossible to put in place the unprecedented restrictions on Iran’s oil exports… absent the increase in North American supply”. Iran would not have yielded if it was not credible that the sanctions could be maintained, and for this to be the case, an oil-price-spike had to be avoided. Prices were already high after the 2010 price spike, shown in figure 3, which preceded the oil sanctions. However, figure 3 also shows that prices remained stable throughout 2012 and 2013 after sanctions were imposed (Fattouh 2014: 7). The IEA (2013: 10) attributed this to the increase in North American supply which: “…clearly played a critical role in offsetting record supply disruptions in 2012…”. The oil industry failed, according to Fattouh (2014: 1), to predict the U.S. production spike. Therefore the success of the oil sanctions was unexpected as well. While increased U.S. production helped “…assuage other governments’ fears of a price spike…” the sanctions did not receive universal support (Blackwill and O’Sullivan 2014: 111). Nevertheless, exports to non-sanctioning countries dropped significantly. For example, Chinese purchases of Iranian oil dropped by 21 % between 2011 and 2013 despite China’s opposition to sanctions. (Katzman 2015: 36). This was achieved because the sanctions were extraterritorial and targeted not just buyers of oil, but also the financial infrastructure and non-U.S. providers of transportation and insurance services that facilitated Iran’s oil trade. This has “…created real pressure on companies to stop purchasing Iranian oil, even if it is not official policy of their host country” (O’Sullivan 2013: 40). Indian refineries for example, reduced their purchases of Iranian oil because they feared losing their insurance, as providers of insurance to purchasers of Iranian oil would be sanctioned (Katzman 2015: 37-38; Van de Graaf 2013, 154).

Another example is that the NDAA threatened to block banks from the U.S. financial markets if they made transactions to Iran’s Central Bank. As a result, 80 % of the hard currency owed to Iran for oil purchases remained stuck in banks in the buyer countries, because the banks feared sanctions (Katzman 2015: 51). The NDAA also promised 180-day sanctions-waivers to companies whose host country had significantly reduced purchases of Iranian oil. A measure of the sanctions’ success is that non-sanctioning countries such as China and India, amongst others, qualified for such waivers in 2013 (Cordesman Gold and Coughlin-Schulte 2013: 40; Katzman 2015: 21). Additionally, the financial and extraterritorial nature of the sanctions seriously impeded Iran’s ability to circumvent the sanctions through the black market (Esfandiary and Fitzpatrick 2011: 145-146).

In contrast to its reaction to the ILSA, the EU supported sanctions by implementing measures of its own, such as completely phasing out purchases of Iranian oil during the first half of 2012. This likely surprised Iran because the EU had never imposed strong sanctions against it in the past (Jervis 2013: 109; Patterson 2013: 137). Another measure was that the EU made it illegal to provide insurance for ships carrying Iranian oil. 95 % of the world’s tanker fleet was insured by a single organization governed by EU-law, and this significantly impeded export to non-sanctioning countries such as China and India (EIA 2014: 17; Patterson 2013: 135-136).

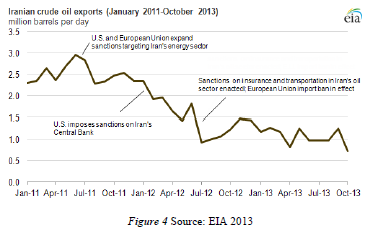

As a result of this effort, Iranian crude oil exports dropped from 2.5 million barrels per day (bbl/d) in 2011 to 1.1 million bbl/d in 2013 as figure 4 illustrates (EIA 2014: 16). This was unprecedented as becomes clear if figure 4 is compared to figure 1. Iran’s oil revenues fell from $ 100 billion in 2011 to only $ 35 billion in 2013. This is significant given that petroleum revenues accounted for 20 % of Iran’s GDP, more than 80 % of its export earnings and 50 % of governmen t revenues. Additionally, its currency plummeted, inflation rose sharply, and its GDP declined by 5 % in 2013 (Katzman 2015: 8, 50-51).

t revenues. Additionally, its currency plummeted, inflation rose sharply, and its GDP declined by 5 % in 2013 (Katzman 2015: 8, 50-51).

It is, according to Van De Graaf (2013: 159): “…clear that the recent oil sanctions against Iran have been more successful than anticipated”, and the case has been made that this was because the U.S. oil production spike was unexpected. The sanctions had a significant impact which likely: “…helped push Tehran to the negotiating table” (Blackwill and O’Sullivan 2014: 111). Iran likely underestimated the potency of the sanctions, and H2 seems probable. However, Iran would not have yielded if it believed that the threat of continued sanctions was noncontingent. So did it?

H3: The threat of sanctions failed because Iran thought that sanctions would be imposed regardless of whether it complied or not. It yielded once it seemed likely that sanctions would be lifted in return.

Iran’s leaders have long believed, and sought to convey to the Iranian public that the real goal of sanctions against it is regime change (Ansari 2013). For example, Supreme Leader Ayatollah Khamenei claimed in a speech held in August 2011 that:

Although the excuse for the sanctions is the issue of nuclear energy, they are lying. . . . Perhaps you recall that the first sanctions against this country were enacted at a time when the nuclear issue absolutely did not exist. . . . Thus, the enemy's goal is to hurl the Islamic Republic to the ground (Ganji 2013, 35-36).

This belief is in Khamenei’s view substantiated in perceived U.S. attempts at undermining the Islamic regime, as well as Western failure to reward Iranian gestures of goodwill such as Iran’s two-year suspension of enrichment activities during the EU3 negotiations (Ganji 2013: 36; Mohsen 2009: 49). Similarly, Maloney (2013: 93) claims that many of Iran’s leaders saw the nuclear issue as a: “…pretext for American sponsored regime change and sanctions as the instrument of the regime’s demise”. Iran’s leadership was therefore convinced that sanctions would remain, even if it agreed to negotiations (Maloney 2013: 95).

The Obama administration was consistent in trying to convey that the goal of sanctions was solely to bring Iran to the negotiating table (O’Sullivan 2010: 11-12). For example, in 2009 in a speech on the occasion of the Iranian New Year, President Obama recognized Iran as an “Islamic Republic” which Parsi (2012: 63) describes as: “…remarkable in the extent to which it was signalling the administration’s willingness to alter America’s approach to Iran”. Obama’s overtures did not convince Iran’s leadership, which Parsi (2012: 217) attributes to its “paralyzing” mistrust of the United States. In fact, as the pressure of sanctions grew after 2010, the Iranian leadership’s suspicions likely did as well (Maloney 2013: 93). Thus, the U.S. failed to convince Iran that sanctions-relief could be obtained through negotiations.

Then in June 2013 Hassan Rouhani, who had campaigned on the pledge of ensuring the end of sanctions through diplomacy, was elected president (Fitzpatrick 2013: 31). Fathollah-Nejad (2014: 63) claims that Rouhani’s election, and not sanctions, explains Iran’s willingness to negotiate. This is not convincing because Khamenei is the “…sole relevant decision maker on the nuclear issue…”, and the president could not have pursued negotiations without Khamenei’s approval (Maloney 2013: 98). After Rouhani’s election, Fitzpatrick (2013: 33-34) observed that: “All indications are that Khamenei remains sceptical about talks and extremely wary of compromise with the United States”. In September 2013, however, Rouhani told reporters that he was fully empowered by Khamenei to pursue nuclear negotiations (Ignatius 2013). So why did Khamenei’s position change?

Sherrill (2014: 70), Chubin (2014: 80) and Dai (2014: 8) argue that the deterioration of Iran’s economy, internal political turmoil and the burden of sanctions meant that Khamenei had to change strategy. The hardline approach had in part brought these woes on Iran, and allowing the election of Rouhani was according to Chubin (2014: 80): “…a calculated gamble…” to explore if the international goodwill Rouhani’s election brought could be exploited to obtain sanctions-relief (Sherrill 2014: 73). With Rouhani as president, pursuing negotiations provided a low-cost way for Khamenei to confirm or disprove his suspicions towards the U.S. because Rouhani would bear the political cost of their success or failure. It was also important that Obama had abandoned the Bush-era precondition of a complete Iranian enrichment halt for negotiations to commence, because this was unacceptable to Iran (Fitzpatrick 2013: 32).

The JPA included several confidence-building measures to encourage Iran’s participation in further negotiations, such as recognition of Iran’s right to nuclear energy for peaceful purposes, and limited sanctions-relief (Bowen and Moran 2014: 44; EEAS 2013). There is a lack of reliable sources on the Iranian decision-making process leading up to the JPA because these events are so recent and because of a lack of transparency. However, the fact that Rouhani was allowed to pursue negotiations until the JPA was finalized, strongly suggests that these confidence building measures succeeded in convincing Iran’s leadership that committing to negotiations would lead to sanctions-relief.

It is nevertheless possible that Iran agreed to negotiations to stall for time while developing a nuclear capability in secret. However, the International Atomic Energy Agency does not believe this to be the case, and, the P5+1 would not have agreed to further negotiations if it believed that Iran was cheating (Bowen and Moran 2014: 49). It does not seem to be the case that this was Iran’s strategy, but this possibility cannot be dismissed completely.

In conclusion, while Iran’s leaders initially saw the threat of sanctions as noncontingent, the burden of sanctions became intolerable. The election of Rouhani did not cause Iran’s change of strategy, but provided Khamenei an opportunity to explore the usefulness of negotiations. The concessions given to Iran during the JPA-negotiations were unprecedented and seem to have convinced Iran’s leadership that the threat of continued sanctions was contingent, though the sources on these negotiations are scarce. H3 seems probable, but cannot be firmly confirmed because of the lack of sources.

8. Implications:

The case has been made that the 2010-2013 sanctions were more successful than anticipated, leading Iran to soften its hardline approach and participate in negotiations with the P5+1. While it initially saw the threat of sanctions as noncontingent, it seems have realized during these negotiations that a deal could lead to sanctions-relief. These findings contradicts Waltz’ (2012: 5) assertion that sanctions against Iran are inconsequential. He is correct that sanctions cannot make Iran abandon its nuclear ambitions, but the sanctions have given the U.S. leverage to push Iran towards accepting a compromise over its nuclear programme.

This does not mean that imposing even stricter sanctions will coerce Iran into making greater concessions. Imposing new sanctions would instead significantly harm the liberal faction of Iranian politics which believes in détente with the West, and would confirm the belief among Iran’s hardliners that the real purpose of sanctions is regime change, and not solving the nuclear issue. Similarly, a failure to reward Iran’s participation in negotiations with sanctions-relief might cause it to revert to a hardline foreign policy approach.

9. Conclusion

This thesis has shown that Iran’s acceptance of the JPA in 2013 resulted from the U.S. sanctions imposed against it after 2010. The sanctions were likely more potent than Iran expected because an unexpected spike in U.S. oil production made oil sanctions against it possible for the first time, and because they forced third-parties into reducing their trade with Iran. Iran’s leadership believed initially that sanctions would be imposed whether it agreed to negotiate with the P5+1 or not, but chose to negotiate when the cost of sanctions became intolerable, and the election of a moderate president in 2013 provided a politically opportune moment. During these negotiations it seems to have realized that a deal would lead to sanctions relief, leading to its acceptance of the JPA.

Sources

Ansari, A. M. (2013) L’ètat, c’est moi: the paradox of sultanism and the question of ‘regime change’ in modern Iran. International Affairs, 89 (2), pp. 283-298.

Blackwill, R. D. and O’Sullivan, M. O. (2014) America’s Energy Edge: The Geopolitical Consequences of the Shale Revolution. Foreign Affairs, 93 (2), pp.102-114.

Bowen, W. Q. and Brewer, J. (2011) Iran’s Nuclear challenge: nine years and counting. International Affairs, 87 (4), pp. 923-943.

Bowen, W. and Moran, M. (2014) Iran’s Nuclear Programme: A Case Study in Hedging? Contemporary Security Policy, 35 (1), pp. 26-52.

Canes, M. E. (2000) Country Impacts of Multilateral Oil Sanctions. Contemporary Economic Policy, 18(2), pp. 135-144.

Chubin, S. (2014) Is Iran a Military Threat? Survival: Global Politics and Strategy, 56 (2), pp. 65-88.

Clarke, M. (2013) Iran as a ‘pariah’ nuclear aspirant. Australian Journal of International Affairs, 67 (4), 491-510.

Cordesman, H., Gold, B. and Coughlin-Schulte, C. (2014) Iran—Sanctions, Energy, Arms Control and Regime Change [Internet], Center for Strategic and International Studies (CSIS) Available from:<http://csis.org/files/publication/140122_Cordesman_IranSanctions_Web.pdf> [Accessed 18.01.2015].

Dai, H. (2014) Hassan Rohani and Javad Zarif’s Work Plan. American Foreign Policy Interests, 36 (7), pp. 7-17.

Der Spiegel (2009) Spiegel Interview with Iran’s Chief Nuclear Negotiator: ‘We Welcome New Sanctions’. Der Spiegel, September, 30 2009 [Internet] Available from:

<http://www.spiegel.de/international/world/spiegel-interview-with-iran-s-chief-nuclear-negotiator-we-welcome-new-sanctions-a-652104.html> [Accessed 08.04.2015]

Drezner, D. W. (2003) The Hidden Hand of Economic Coercion. International Organization, 57 (3), pp. 643-659.

EEAS (2013) Joint Plan of Action [Internet], European External Action Service (EEAS). Available from: <http://eeas.europa.eu/statements/docs/2013/131124_03_en.pdf> [Accessed 20.01.2015].

EIA (2013) Iran’s oil exports not expected to increase significantly despite recent negotiations [Internet], U.S. Energy Information Administration (EIA). Available from <http://www.eia.gov/todayinenergy/detail.cfm?id=14111> [Accessed 12.02.2015]

EIA (2014) Country Analysis Brief: Iran [Internet], U.S. Energy Information Administration. Available from: <http://www.eia.gov/beta/international/analysis_includes/countries_long/Iran/iran.pdf> [Accessed 18.01.2015].

EIA (2015a) International Energy Statistics [Internet], U.S. Energy Information Administration. Available from:

<http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=57&aid=4&cid=I R,&syid=1986&eyid=2010&unit=TBPD> [Accessed 29.03.2015]

EIA (2015b) International Energy Statistics [Internet], U.S. Energy Information Administration. Available from:

<http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=57&aid=1&cid=S A,US,&syid=2006&eyid=2013&unit=TBPD> [Accessed 29.03.2015]

EIA (2015c) Petroleum & Other Liquids [Internet], U.S. Energy Information Administration. Available from:

<http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rbrte&f=m> [Accessed 25.05.2015]

Emery, C. (2010) The transatlantic and Cold War dynamics of Iran sanctions, 1979-1980. Cold War History, 10 (3), pp. 371-396.

Esfandiary, D. and Fitzpatrick, M. (2011) Sanctions on Iran: Defining and Enabling ‘Success’. Survival, 53 (5), pp. 143-156.

Fathollah-Nejad, A. (2014) Why Sanctions Against Iran are Counterproductive: Conflict Resolution and State-Society Relations. International Journal, 69 (1), pp. 48-65.

Fattouh, B. (2014) The US Tight Oil Revolution and Its Impact on the Gulf Cooperation Council Countries: Beyond the Supply Shock [Internet], The Oxford Institute for Energy Studies. Available from: <http://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/10/WPM-54.pdf> [Accessed 20.02.2015]

Fitzpatrick, M. (2013) Reinforce Rowhani’s Mandate for Change. Survival, 55(4), pp. 31-34.

Ganji, A. (2013) Who Is Ali Khamenei? The Worldview of Iran’s Supreme Leader. Foreign Affairs, 92 (5), pp. 24-48.

Gerring, J. (2007) Case Study Research: Principles and Practices. New York, Cambridge University Press.

Gheissari, A. and Nasr, V. (2005) The conservative consolidation in Iran. Survival, 47 (2), pp. 175-190.

Gosden, E. (2012) IMF: Iran sanctions could push oil to $140. The Telegraph, January, 25 2012 [Internet] Available from:

<http://www.telegraph.co.uk/finance/oilprices/9039596/IMF-Iran-sanctions-could-push-oil-to-140.html> [Accessed 21.02.2015].

Hovi, J., Huseby, R. and Sprinz, D. F. (2005) When Do (Imposed) Economic Sanctions Work? World Politics, 57 (4), pp. 479-499.

Hufbauer, G. C., Schott, J. J., Elliott, K. A. and Oegg, B. (2007) Economic Sanctions Reconsidered: History and Current Policy. 3. ed. Washington, D. C. Peterson Institute for International Economics.

IEA (2012) Oil: Medium-Term Market Report 2012 [Internet], International Energy Agency (IEA). Available from:

<http://www.iea.org/publications/freepublications/publication/mtomr2012web.pdf> [Accessed 18.03.2015].

IEA (2013) Oil: Medium-Term Market Report 2013 [Internet], International Energy Agency. Available from:

<http://www.iea.org/publications/freepublications/publication/MTOMR2013_free.pdf > [Accessed 18.03.2015].

Ignatius, D. (2013) David Ignatius: Iranian president seeks a speedy nuclear deal. Opinion Piece. The Washington Post, September 25, 2013 [Internet] Available from: <http://www.washingtonpost.com/opinions/david-ignatius-iranian-president-seeks-a-speedy-nuclear-deal/2013/09/25/c62aff32-261d-11e3-ad0d-b7c8d2a594b9_story.html> [Accessed 18.04.2015]

Jervis, R. (2013) Getting to Yes With Iran: The Challenges of Coercive Diplomacy. Foreign Affairs, 92 (1), pp. 105-115.

Katzman, K. (2015) Iran Sanctions [Internet], Congressional Research Service. Available from: <https://www.fas.org/sgp/crs/mideast/RS20871.pdf> [Accessed 21.02.2015].

Lindsay, J. M. (1986) Trade Sanctions as Policy Instruments: A Re-Examination. International Studies Quarterly, 30 (2), pp. 153-173.

Levy, J. S. (2008) Case Studies: Types, Designs, and Logics of Inference. Conflict Management and Peace Science, 25 (1), pp. 1-18.

Maloney, S. (2010) Sanctioning Iran: If Only it Were so Simple. The Washington Quarterly, 33 (1), pp. 131-147.

Maloney, S. (2013) Engagement with Iran: The Sequel. The Fletcher Forum of World Affairs, 37 (1), pp. 91-103.

Mohsen, M. M. (2009) Tehran’s Take: Understanding Iran’s U.S. Policy. Foreign Affairs, 88 (4), pp. 46-62.

Morse, E. L. (2014) Welcome to the Revolution: Why Shale Is the Next Shale. Foreign Affairs, 93 (3), pp. 3-7.

Nader, A. (2012) Influencing Iran’s decisions on the nuclear program. In: Solingen, E. ed. Sanctions, Statecraft, and Nuclear Proliferation. Cambridge, Cambridge University Press, pp. 211-231.

O’Sullivan, M. L. (2010) Iran and the Great Sanctions Debate. The Washington Quarterly, 33 (4), pp. 7-21.

O’Sullivan, M. L. (2013) The Entanglement of Energy, Grand Strategy, and International Security, In: Goldthau, A. ed. The Handbook of Global Energy Policy. Chichester, UK, Wiley-Blackwell, pp. 30-47.

Pape, R. A. (1997) Why Economic Sanctions Do Not Work. International Security, 22 (2), pp. 90-136.

Parsi, T. (2012) A Single Roll of the Dice. New Haven and London, Yale University Press.

Patterson, R. (2013) EU Sanctions on Iran: The European Political Context. Middle East Policy, 20 (1), pp. 135-146.

Samore, G. (2015) Deal With It: How to Turn the Framework Agreement into a Comprehensive Nuclear Deal. Foreign Affairs, April, 5 2015 [Internet] Available from: <http://www.foreignaffairs.com/articles/143640/gary-samore/deal-with-it> [Accessed 07.04.2015].

Schott, J. J. (2012) Economic Sanctions Against Iran: Is the Third Decade a Charm? Business Economics, 47 (3), pp. 190-192.

Sherrill, C. W. (2014) Why Hassan Rouhani Won Iran’s 2013 Presidential Election. Middle East Policy, 21 (2), pp. 64-75.

Solingen, E. (2012) Ten dilemmas in nonproliferation statecraft. In: Solingen, E. ed. Sanctions, Statecraft, and Nuclear Proliferation. Cambridge, Cambridge University Press, pp. 297-351.

Takeyh, R. and Maloney, S. (2011) The self-limiting success of Iran sanctions. International affairs, 87 (6), pp. 1297-1312.

Van de Graaf, T. (2013) The “Oil Weapon” Reversed? Sanctions Against Iran and U.S.-EU Structural Power. Middle East Policy, 20 (3), pp. 145-163.

Waltz, K. N. (2012) Why Iran Should Get the Bomb: Nuclear Balancing Would Mean Stability. Foreign Affairs, 91 (4), pp. 2-5.