In our study Public R&D support and firms' performance, we have evaluated the effect of public R&D subsidies on firms' performance in Norwegian industries. In Norway, there are three major sources of public R&D subsidy programs:

- Innovation Norway (IN)

- The Research Council of Norway (RCN)

- The R&D tax credit scheme Skattefunn (SKF)

The limited amount of subsidy programs, the long length of the analyzed period (2002-2013) and the possibility to link policy instruments with firm level data makes this study unique compared to existing literature.

How to measure effects of R&D support?

The effectiveness of public R&D support programs has been analyzed in many prior studies. A survey of some early firm-level econometric studies is given by Klette et al. (2000), with focus on the problem of establishing a valid control group. While the early literature is hampered by methodological flaws (see David et al., 2000), the more recent studies are generally aware of methodological challenges. Examples include: Czarnitzki and Licht (2006) (German firms), Cappelen et al. (2012) (Norwegian firms), Lokshin and Mohnen (2013) (Dutch firms), Dumont (2017) (Belgian firms), and Dechezlepretre et al. (2016) (UK firms).

Building on the existing literature, we estimated the effect of public R&D support by means matching: firms that received support were matched with a control group of firms that did not receive any support, using a combination of stratification (by industry, firm cohort and region) and propensity score matching (within each stratum). We then compared changes in performance indicators in the treatment group -- before and after support -- with contemporaneous changes in the control group.

Public R&D support programs have effects - but there are caveats

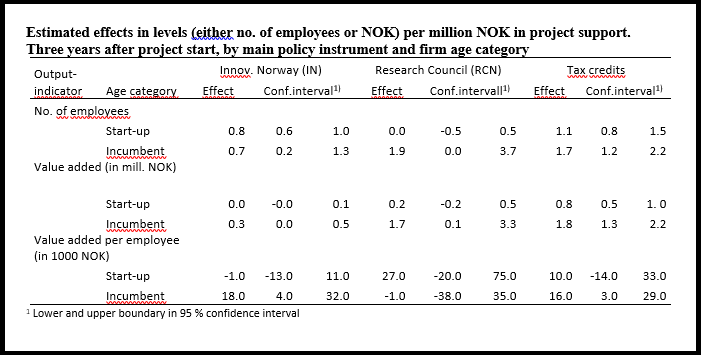

The table below shows estimated average effects of 1 mill. NOK in R&D support for each main policy instrument, with separate estimates for incumbents and start-up firms (start-up: maximum 3 years old at project start). The main results are:

- The average effect of 1 million NOK in project support from IN to incumbent firms is 0.7 new employees and 0.3 million NOK in increased value added after three years.

- The corresponding estimates for RCN and SKF are 1.9 and 1.7 new employees and 1.7 and 1.8 million added growth, respectively.

- Value added for start-up firms does not increase significantly neither for IN nor RCN support, while the estimated average increase is significant for tax credits: 0.8 million NOK.

Unimpressive results for start-ups

To sum up: the average effects of R&D support among those who obtained grants and/or tax credits are mostly positive and significant for incumbent firms. Among start-ups, neither support from IN nor from RCN contribute significantly to value added or labor productivity growth, although the effect is significant w.r.t. value added for a typical start-up firm receiving tax credits: the estimate is 800 000 NOK in increased value added during 3 years per million NOK in funding.

These modest, or even negative findings with regard to public policies supporting start-ups are consistent with various existing studies; both Norwegian ones (see the Auditor-General’s evaluation of public seed capital funds; Riksrevisjonen, 2016) and international (see Acs et.al., 2016; and Astebro, 2017). On the other hand, Hottenrot et.al. (2017) find that subsidized start-ups have higher probability of attracting bank funding than non-subsidized ones.

This evidence indicates that public financial instruments may trigger additional private financing, but that the effects in terms of increased value added and productivity are weak.

More research is warranted to inform public policies on how – or whether – to stimulate R&D and innovation among young firms in particular.

References

Acs, T., T. Åstebro, D. Audretsch, and D. Robinson (2016): Public policy to promote entrepreneurship: a call to arms. Small Business Economics, 47, pp. 35-41.

Astebro, T. (2017): The private financial gains to entrepreneurship: Is it a good use of public money to encourage individuals to become entrepreneurs? Small Business Economics, (48), pp. 323–329.

Cappelen. Å., A. Raknerud and M. Rybalka (2012). The effects of R&D tax credits on patenting and innovations. Research Policy. 41. 334-345.

Czarnitzki, D. and G. Licht (2006). Additionality of public R&D grants in a transition economy: The case of Eastern Germany. Economics of Transition, 14(1), 101-131

David, P. A., B. Hall and A.A. Toole (2000). “Is public R&D a complement or substitute for private R&D? A review of the econometric evidence”. Research Policy, 29, 472–495.

Dechezleprêtre, A, E. Einiö, R. Martin, K-T Nguyen, J. van Reenen (2016). Do Tax Incentives for Research Increase Firm Innovation? An RD Design for R&D, CEP Discussion Paper No 1413

Dumont, M. (2017). Assessing the policy mix of public support to business R&D, Research Policy 46 (10), pp 1851-1862

Klette,T.J., J. Møen, Z. Griliches (2000). Do subsidies to commercial R&D reduce market failures? Microeconometric evaluation studies. Research Policy. 29, 471-495.

Lokshin, B. and P. Mohnen (2013). Do R&D tax incentives lead to higher wages for R&D workers? Evidence from the Netherlands, Research Policy, 42(3), 823-830.

Hottenrot, H., E. Lins and E. Lutz (2017): Public subsidies and new ventures’ use of bank loans. Economics of Innovation and new technology, Vol. 8.

Nilsen, Ø.A., Raknerud, A. and Iancu, D.C. (2018): Public R&D support and firms’ performance: A panel data study. Discussion Papers 878, Statistics Norway. Invited to resubmit to Research Policy

Riksrevisjonen (2016): Riksrevisjonens undersøkelse av såkornfondenes resultater. Dokument 3:8 (2015–2016), Riksrevisjonen, Oslo. In Norwegian

Log in to comment

Not UiO or Feide account?

Create a WebID account to comment